NOTE!!! There is PROBLEM with this book. The second half of the book is complete BULLSHIT - the author begins to advocate BORROWING and using loans. Ignore this second part. I would hope most of you would have the brains [moran] to figure that out, but still.

BEANIE-CAP for BEANIE-BRAINS

No, this is NOT fake. There is now for sale an 'infowars', club-infowarrior cadet, vice-scout, level 3, arch-cleric, wool knit BEANIE CAP!! Wear your beanie caps infowariors! Fight the good fight against that government boogie man that made you take out your 300k mortgage and your $120k in student loans. MORANS! Jones is officially a genius for getting these MORANS to buy a benie-cap! Beanie caps for beanie-brains! ... LOL!

Tuesday, March 3, 2009

Housing bubble gentrification yuppie implosion

Here we have a great parody of the typical housing boom era yuppie beta male along with his hot boss-wife. It's a sickening and all too familiar sight here in philly - It never ceases to amaze me how the sheeple, who swear they are free individuals, cannot see that they are CLEARLY falling into a pre-defined role.

Right on down to the way they dress, act, etc. I mean, seriously - at what point do you walk out of your $300K McRow home in the ghetto and notice the other Midwestern pap next to you, doing and acting the same way?

At what point do you notice you have the same plastic, absurdly overpriced house in the ghetto, the same number of dogs, the same cars, the same hot wife, etc.. before you realize you are a novelty?

Ahh yes - if only the sheep had a brain he would realize that he is only another in the herd. But the truth is he LOVES being a sheep....

Anyway - i digress... take a look below....

That's the REAL version of the parody photo above --- This is a REAL PHOTO featured in todays USA TODAY news article (below) --- just like the programming dictates: the woman will be an attractive boss wife, the man is an unattractive, possibly gay shlep of a beta male who resembles a walking ATM.

But uh-oh - now days in debt!! That's right the reality of a $300k adjustable rate mortgage + student loans + 2 kids to support + wifeys credit card debt is hitting home! The sheep who built his entire life of fake money (credit money/soft money) is realizing that ... he had.. and was... and is...nothing....

The rates of divorces, suicides, domestic homicides, and women going for gangtas is going to skyrocket in the coming months.

But first... read their pathetic story about how they got into their self-inflicted bullshit:

(from USATODAY)

"Michael and Cynthia Russell wanted to move to New York City, where they both work. Jobs are more plentiful there than in their town of Poughkeepsie, N.Y. But like millions of Americans today, the couple are stuck. They owe about $80,000 more on the home they bought in 2004 than it is now worth.

So instead of selling their home, Cynthia is going to school to become a registered nurse and Michael is working from home.

"We have had to find opportunities closer to home," Michael Russell says. "We actually began trying to refinance in June 2007, but absolutely no one would take us."

It's a problem that's only expected to get worse for legions of homeowners across the USA. Nearly one in seven homeowners is underwater, owing more on their mortgages than their homes are worth. That's about 12 million homeowners, nearly double the number underwater at the end of 2007, according to Moody's Economy.com. Most are homeowners who bought between late 2003 and 2007.

Home prices are projected to drop on average another 10%, bringing to about 14.6 million the number of homeowners who will be underwater on their mortgages by fall 2009, says Mark Zandi, chief economist at Moody's Economy.com. By contrast, about 2.5 million homeowners had negative equity in their homes in 2006.

FIND MORE STORIES IN: California | Florida | New York City | Phoenix | Louisiana | Wyoming | Moody | Economy.com | Mark Zandi | Lancaster | Poughkeepsie | Jacuzzi | Juli | AOL Real Estate | Atlas Van Lines

Increasingly, job seekers find that their homes are albatrosses imperiling their ability to relocate for higher incomes or more secure job opportunities. In fact, the greatest drop in home prices, in many cases, is in areas with the sharpest rise in unemployment.

"It's a pretty alarming trend," says Alan Steel, general manager of AOL Real Estate.

In California, about 18% of homeowners owe more on their first mortgages than their homes are worth. In Florida, it's nearly one in four. Half of homeowners in Louisiana are underwater on their first mortgages.

Paying on 'a lost cause'

Ken Schimpf, 61, a retired carpenter in Lancaster, Calif., briefly toyed with the idea of moving to Wyoming so he could be closer to his oldest son and live in an area where he could find work more easily. But he's trapped by his house.

In August 2005, Ken and his wife, Juli, bought their home in Lancaster for $330,000. It seemed ideal at the time. The 1,900-square-foot, three-bedroom house includes an expansive master suite with a Jacuzzi, a pool, and 2.5-car garage where he keeps a 1923 T-Bucket hot rod that he and his wife worked on.

They got an interest-only loan at 5.25%, with the rate locked in for five years.

But in January 2006, Juli was diagnosed with leukemia. She spent months in and out of the hospital. Ken eventually took a leave of absence from work to help care for her. She died last March. Now Ken is trying to make his mortgage payment of $2,600 a month by relying on his retirement pension of $1,900 a month and savings. He doesn't want to lose the house because it's also home to two adult children: a son who was laid off and a daughter who is working temporary jobs. In September, his mortgage payments will increase by almost $500 a month when the interest-only teaser runs out.

He's selling his hot rod collection, looking for work and fast depleting his savings to make ends meet. Plans to sell the house were thwarted when he discovered the property is worth about $90,000 less than he paid for it. He doesn't want to just walk away from the home because he fears that would devastate his credit.

"I really hate putting the money out each month into what appears to be a lost cause," Schimpf says. "I just hope the economy turns around before too long so people can once again realize that owning a home is the American dream and not the American nightmare."

The inability to relocate because of negative home equity isn't just hurting workers who want to move for better jobs. It's also straining employers. Employees and new hires are increasingly turning down relocation opportunities because of the housing market. A 2008 corporate relocation survey by Atlas Van Lines found that "family ties" was the top reason (62%) cited by companies for workers declining relocations. That was a sharp drop from 84% last year. By contrast, 50% of companies said employees cited "housing and mortgages concerns" as the reason for turning down relocation offers, vs. 30% in 2007.

The dramatic shift is forcing businesses to offer more generous relocation assistance at the same time they're facing significant pressures to curtail costs because of the lackluster economy. In fact, the number of firms offering lump sum payments to transferees and new hires is at the highest in six years.

Some homeowners are so certain that their homes won't appreciate anytime soon that they have pondered simply walking away. Accountant Jason Khan, 33, owes about $80,000 more on his Phoenix home than it's worth in today's market.

"I am not in danger of losing my house. I have no problem paying my mortgage payments," he says in an e-mail. "However, I have considered walking away from my house and buying another … or making late payments to see if my mortgage company will renegotiate my principal with me."

For the most part, lenders will only ease loan terms for homeowners who are at risk of default or foreclosure.

Home prices keep on falling

Economists say a rebound in the housing market is still months away. The drop in home prices has shown no signs of letting up. And at least $500 billion worth of option-ARM loans are expected to reset from mid-2009 through 2012, driving up monthly mortgage payments for homeowners.

That could lead to a wave of new foreclosures that "could drive down home prices and leave more people underwater," Zandi says.

Jim Fawcett of Houston says the 6% decline in his home's value is just enough of a drop to keep him from retiring and moving inland from the coast.

"There's probably no way I could even sell my house in this market — short of giving it away," says Fawcett, 70. "Homes in my area, a newer development, sit on the market for six months, don't sell, then are taken off."

Mara Stefan's house is an unwanted reminder of her life before divorce. "As part of the settlement, I'm stuck in a house I don't want to live in," says Stefan, 42, who works in consumer technology and whose suburban Boston home is $60,000 underwater. She would love to move with her sons, Eric, 15, and Ethan, 6. "But it looks like I'll have to be here awhile."

END OF ARTICE

Now I just LOVE how, the boss wife female sheep in the first story thinks the solution to mounting debt, bills, and inability to sell and move ...is.............................................

....

.....drum roll..............

MORE DEBT!!!! "I know honey, were totally broke AND in debt! So let's take out a huge student LOAN to get ahead!"

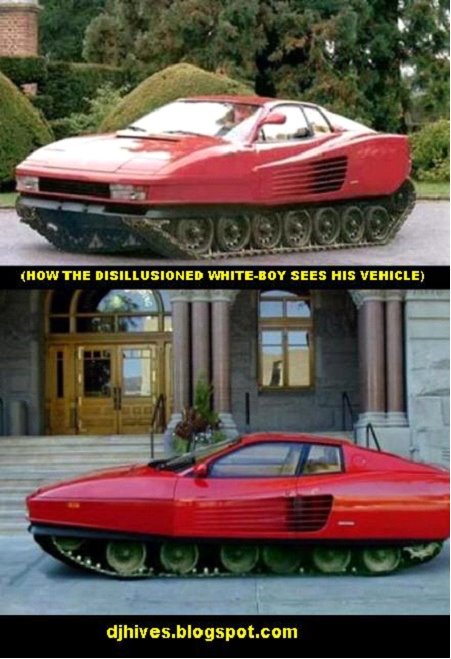

The lunatic sheep and his delusions of BORROWING (DEBT) to get rich!

May the New World Order lock these people UNDER the work-camp!

NOW TAKE A LOOK AT THIS!!!!!

You just CAN'T make this up! LOL - are they twins???

You simply must marvel at the Benevolent Illuminati's ability to manage cattle into precise forms - proof again that this drama is going to play out exactly as I predicted - and exactly how, to anyone who knows the science, KNOWS will happen...

Posted by djhives 3 comments

Reactions:

the money expert is here

Hello my children:

Today I shall talk about the coming melt-down.

Here's what we got:

Millions of sheeple stuck in houses they cannot afford. Because they were greedy they are now facing foreclosure -- next come the job losses associated with the lack of credit int he general economy. And since most businesses are sheep-businesses they too rely on credit to keep going.

Let's stop for a moment and look at this human condition of credit addiction...

I mean what a concept - let's just borrow money and have a nice day! Want a car - borrow for it! Want a house? borrow for it! Want a college education? Borrow for it. Want 'stuff'? borrow for it!

That's what this global farm of cattle have been doing for centuries. And now it's all coming to an end.

What will happen when the credit is shut off? Will people finally learn to live -within- their means? Will they rent and save? Will they work rather than borrow to get what they want?

Or are they too lazy and insane to realize that work brings freedom? Will they realize that working for money gets you things you want?

Or will they behave like children and cry "but MOMMY I WANNNA HOUSE NOW!! and daddy i wanna car NOW.... i wanna.. i wanna.. now... now....."

My children - you will witness shortly after the presidential inauguration a nationwide reality check of biblical proportions. No more credit kids. If you don't work and save for what you want - THEN YOU DONT GET IT!.

Period. Any non-compliance with this law of nature, and you will be Section-8'ed.

A nation of people who will not work for what they want, who must rely on credit to get what they want, is a nation of welfare addicts - and what will happen in a few weeks will mark the beginnings of the welfare state the sheeple of this country have begged to be put into.

It amazes me how the average sheep thinks of his 'worth'... he literally thinks his DEBT is an ASSERT! ...just walk up to a gentrification yuppie who 'paid' 300K for his house - he will literally think he is worth $300K! Never can his mind comprehend that he is $300K IN DEBT as he guzzles his morning coffee and runs out the door so as not to be late for his 40 hour a week slave in the bio magnetic slave hive where he pushes papers and punches numbers for 8 hours a day before he is released into the general population at 5pm where he can reap havock on the highways with fits of road-rage and spitting drool and fast food hamburgers.

He arrives at his debt-house-money-pit of a home he still owes $320K on (interest gave him $20 extra K this year alone so far..) to find an anemic wife-boss, who serves as the guardian to the feminist code, microwaving him a TV dinner.

He plops down in front of the telescreen watching the days fantasy news on CNN while his wife grows angry that he is becoming more and more delinquent on the bills each month. Her beta-male walking ATM is dissolving before her eyes - perhaps that's why when she serves him his Swanson Chicken and brownie meal her fingers smell like vagina and black mailman.

How or why this beta-male slave, captain of mediocre genes can go on living a lie is a big thing to explain. But the main answer is a high delusional feeling of self entitlement.

But now his house, wife, car, and stuff are vanishing.

Did it ever cross his mind to think that when ever you borrow a dollar you must pay back a dollar fifty!

What that translated to, my children is this: ... the car, the wife, the stuff, the house... even the KIDS... are ALL gonna GO BACK to the lender... anything you borrow ALWAYS has to be RETURNED.... get it????

time to ante up fools.

Right on down to the way they dress, act, etc. I mean, seriously - at what point do you walk out of your $300K McRow home in the ghetto and notice the other Midwestern pap next to you, doing and acting the same way?

At what point do you notice you have the same plastic, absurdly overpriced house in the ghetto, the same number of dogs, the same cars, the same hot wife, etc.. before you realize you are a novelty?

Ahh yes - if only the sheep had a brain he would realize that he is only another in the herd. But the truth is he LOVES being a sheep....

Anyway - i digress... take a look below....

That's the REAL version of the parody photo above --- This is a REAL PHOTO featured in todays USA TODAY news article (below) --- just like the programming dictates: the woman will be an attractive boss wife, the man is an unattractive, possibly gay shlep of a beta male who resembles a walking ATM.

But uh-oh - now days in debt!! That's right the reality of a $300k adjustable rate mortgage + student loans + 2 kids to support + wifeys credit card debt is hitting home! The sheep who built his entire life of fake money (credit money/soft money) is realizing that ... he had.. and was... and is...nothing....

The rates of divorces, suicides, domestic homicides, and women going for gangtas is going to skyrocket in the coming months.

But first... read their pathetic story about how they got into their self-inflicted bullshit:

(from USATODAY)

"Michael and Cynthia Russell wanted to move to New York City, where they both work. Jobs are more plentiful there than in their town of Poughkeepsie, N.Y. But like millions of Americans today, the couple are stuck. They owe about $80,000 more on the home they bought in 2004 than it is now worth.

So instead of selling their home, Cynthia is going to school to become a registered nurse and Michael is working from home.

"We have had to find opportunities closer to home," Michael Russell says. "We actually began trying to refinance in June 2007, but absolutely no one would take us."

It's a problem that's only expected to get worse for legions of homeowners across the USA. Nearly one in seven homeowners is underwater, owing more on their mortgages than their homes are worth. That's about 12 million homeowners, nearly double the number underwater at the end of 2007, according to Moody's Economy.com. Most are homeowners who bought between late 2003 and 2007.

Home prices are projected to drop on average another 10%, bringing to about 14.6 million the number of homeowners who will be underwater on their mortgages by fall 2009, says Mark Zandi, chief economist at Moody's Economy.com. By contrast, about 2.5 million homeowners had negative equity in their homes in 2006.

FIND MORE STORIES IN: California | Florida | New York City | Phoenix | Louisiana | Wyoming | Moody | Economy.com | Mark Zandi | Lancaster | Poughkeepsie | Jacuzzi | Juli | AOL Real Estate | Atlas Van Lines

Increasingly, job seekers find that their homes are albatrosses imperiling their ability to relocate for higher incomes or more secure job opportunities. In fact, the greatest drop in home prices, in many cases, is in areas with the sharpest rise in unemployment.

"It's a pretty alarming trend," says Alan Steel, general manager of AOL Real Estate.

In California, about 18% of homeowners owe more on their first mortgages than their homes are worth. In Florida, it's nearly one in four. Half of homeowners in Louisiana are underwater on their first mortgages.

Paying on 'a lost cause'

Ken Schimpf, 61, a retired carpenter in Lancaster, Calif., briefly toyed with the idea of moving to Wyoming so he could be closer to his oldest son and live in an area where he could find work more easily. But he's trapped by his house.

In August 2005, Ken and his wife, Juli, bought their home in Lancaster for $330,000. It seemed ideal at the time. The 1,900-square-foot, three-bedroom house includes an expansive master suite with a Jacuzzi, a pool, and 2.5-car garage where he keeps a 1923 T-Bucket hot rod that he and his wife worked on.

They got an interest-only loan at 5.25%, with the rate locked in for five years.

But in January 2006, Juli was diagnosed with leukemia. She spent months in and out of the hospital. Ken eventually took a leave of absence from work to help care for her. She died last March. Now Ken is trying to make his mortgage payment of $2,600 a month by relying on his retirement pension of $1,900 a month and savings. He doesn't want to lose the house because it's also home to two adult children: a son who was laid off and a daughter who is working temporary jobs. In September, his mortgage payments will increase by almost $500 a month when the interest-only teaser runs out.

He's selling his hot rod collection, looking for work and fast depleting his savings to make ends meet. Plans to sell the house were thwarted when he discovered the property is worth about $90,000 less than he paid for it. He doesn't want to just walk away from the home because he fears that would devastate his credit.

"I really hate putting the money out each month into what appears to be a lost cause," Schimpf says. "I just hope the economy turns around before too long so people can once again realize that owning a home is the American dream and not the American nightmare."

The inability to relocate because of negative home equity isn't just hurting workers who want to move for better jobs. It's also straining employers. Employees and new hires are increasingly turning down relocation opportunities because of the housing market. A 2008 corporate relocation survey by Atlas Van Lines found that "family ties" was the top reason (62%) cited by companies for workers declining relocations. That was a sharp drop from 84% last year. By contrast, 50% of companies said employees cited "housing and mortgages concerns" as the reason for turning down relocation offers, vs. 30% in 2007.

The dramatic shift is forcing businesses to offer more generous relocation assistance at the same time they're facing significant pressures to curtail costs because of the lackluster economy. In fact, the number of firms offering lump sum payments to transferees and new hires is at the highest in six years.

Some homeowners are so certain that their homes won't appreciate anytime soon that they have pondered simply walking away. Accountant Jason Khan, 33, owes about $80,000 more on his Phoenix home than it's worth in today's market.

"I am not in danger of losing my house. I have no problem paying my mortgage payments," he says in an e-mail. "However, I have considered walking away from my house and buying another … or making late payments to see if my mortgage company will renegotiate my principal with me."

For the most part, lenders will only ease loan terms for homeowners who are at risk of default or foreclosure.

Home prices keep on falling

Economists say a rebound in the housing market is still months away. The drop in home prices has shown no signs of letting up. And at least $500 billion worth of option-ARM loans are expected to reset from mid-2009 through 2012, driving up monthly mortgage payments for homeowners.

That could lead to a wave of new foreclosures that "could drive down home prices and leave more people underwater," Zandi says.

Jim Fawcett of Houston says the 6% decline in his home's value is just enough of a drop to keep him from retiring and moving inland from the coast.

"There's probably no way I could even sell my house in this market — short of giving it away," says Fawcett, 70. "Homes in my area, a newer development, sit on the market for six months, don't sell, then are taken off."

Mara Stefan's house is an unwanted reminder of her life before divorce. "As part of the settlement, I'm stuck in a house I don't want to live in," says Stefan, 42, who works in consumer technology and whose suburban Boston home is $60,000 underwater. She would love to move with her sons, Eric, 15, and Ethan, 6. "But it looks like I'll have to be here awhile."

END OF ARTICE

Now I just LOVE how, the boss wife female sheep in the first story thinks the solution to mounting debt, bills, and inability to sell and move ...is.............................................

....

.....drum roll..............

MORE DEBT!!!! "I know honey, were totally broke AND in debt! So let's take out a huge student LOAN to get ahead!"

The lunatic sheep and his delusions of BORROWING (DEBT) to get rich!

May the New World Order lock these people UNDER the work-camp!

NOW TAKE A LOOK AT THIS!!!!!

You just CAN'T make this up! LOL - are they twins???

You simply must marvel at the Benevolent Illuminati's ability to manage cattle into precise forms - proof again that this drama is going to play out exactly as I predicted - and exactly how, to anyone who knows the science, KNOWS will happen...

Posted by djhives 3 comments

Reactions:

the money expert is here

Hello my children:

Today I shall talk about the coming melt-down.

Here's what we got:

Millions of sheeple stuck in houses they cannot afford. Because they were greedy they are now facing foreclosure -- next come the job losses associated with the lack of credit int he general economy. And since most businesses are sheep-businesses they too rely on credit to keep going.

Let's stop for a moment and look at this human condition of credit addiction...

I mean what a concept - let's just borrow money and have a nice day! Want a car - borrow for it! Want a house? borrow for it! Want a college education? Borrow for it. Want 'stuff'? borrow for it!

That's what this global farm of cattle have been doing for centuries. And now it's all coming to an end.

What will happen when the credit is shut off? Will people finally learn to live -within- their means? Will they rent and save? Will they work rather than borrow to get what they want?

Or are they too lazy and insane to realize that work brings freedom? Will they realize that working for money gets you things you want?

Or will they behave like children and cry "but MOMMY I WANNNA HOUSE NOW!! and daddy i wanna car NOW.... i wanna.. i wanna.. now... now....."

My children - you will witness shortly after the presidential inauguration a nationwide reality check of biblical proportions. No more credit kids. If you don't work and save for what you want - THEN YOU DONT GET IT!.

Period. Any non-compliance with this law of nature, and you will be Section-8'ed.

A nation of people who will not work for what they want, who must rely on credit to get what they want, is a nation of welfare addicts - and what will happen in a few weeks will mark the beginnings of the welfare state the sheeple of this country have begged to be put into.

It amazes me how the average sheep thinks of his 'worth'... he literally thinks his DEBT is an ASSERT! ...just walk up to a gentrification yuppie who 'paid' 300K for his house - he will literally think he is worth $300K! Never can his mind comprehend that he is $300K IN DEBT as he guzzles his morning coffee and runs out the door so as not to be late for his 40 hour a week slave in the bio magnetic slave hive where he pushes papers and punches numbers for 8 hours a day before he is released into the general population at 5pm where he can reap havock on the highways with fits of road-rage and spitting drool and fast food hamburgers.

He arrives at his debt-house-money-pit of a home he still owes $320K on (interest gave him $20 extra K this year alone so far..) to find an anemic wife-boss, who serves as the guardian to the feminist code, microwaving him a TV dinner.

He plops down in front of the telescreen watching the days fantasy news on CNN while his wife grows angry that he is becoming more and more delinquent on the bills each month. Her beta-male walking ATM is dissolving before her eyes - perhaps that's why when she serves him his Swanson Chicken and brownie meal her fingers smell like vagina and black mailman.

How or why this beta-male slave, captain of mediocre genes can go on living a lie is a big thing to explain. But the main answer is a high delusional feeling of self entitlement.

But now his house, wife, car, and stuff are vanishing.

Did it ever cross his mind to think that when ever you borrow a dollar you must pay back a dollar fifty!

What that translated to, my children is this: ... the car, the wife, the stuff, the house... even the KIDS... are ALL gonna GO BACK to the lender... anything you borrow ALWAYS has to be RETURNED.... get it????

time to ante up fools.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment