NOTE!!! There is PROBLEM with this book. The second half of the book is complete BULLSHIT - the author begins to advocate BORROWING and using loans. Ignore this second part. I would hope most of you would have the brains [moran] to figure that out, but still.

BEANIE-CAP for BEANIE-BRAINS

No, this is NOT fake. There is now for sale an 'infowars', club-infowarrior cadet, vice-scout, level 3, arch-cleric, wool knit BEANIE CAP!! Wear your beanie caps infowariors! Fight the good fight against that government boogie man that made you take out your 300k mortgage and your $120k in student loans. MORANS! Jones is officially a genius for getting these MORANS to buy a benie-cap! Beanie caps for beanie-brains! ... LOL!

Monday, March 9, 2009

The Great College Hoax (COLLEGE IS FOR MORANS!!!)

Didn't I tell you college was for MORANS? A slave school? Stupidity academy? Debt slave dependency collar? Enjoy...

The Great College Hoax

Law Students in Heavy Debt

Kathy Kristof 02.02.09

Forbes

As steadily as ivy creeps up the walls of its well-groomed campuses, the education industrial complex has cultivated the image of college as a sure-fire path to a life of social and economic privilege.

Joel Kellum says he's living proof that the claim is a lie. A 40-year-old Los Angeles resident, Kellum did everything he was supposed to do to get ahead in life. He worked hard as a high schooler, got into the University of Virginia and graduated with a bachelor's degree in history.

Accepted into the California Western School of Law, a private San Diego institution, Kellum couldn't swing the $36,000 in annual tuition with financial aid and part-time work. So he did what friends and professors said was the smart move and took out $60,000 in student loans.

Kellum's law school sweetheart, Jennifer Coultas, did much the same. By the time they graduated in 1995, the couple was $194,000 in debt. They eventually married and each landed a six-figure job. Yet even with Kellum moonlighting, they had to scrounge to come up with $145,000 in loan payments. With interest accruing at up to 12% a year, that whittled away only $21,000 in principal. Their remaining bill: $173,000 and counting.

Kellum and Coultas divorced last year. Each cites their struggle with law school debt as a major source of stress on their marriage. "Two people with this much debt just shouldn't be together," Kellum says.

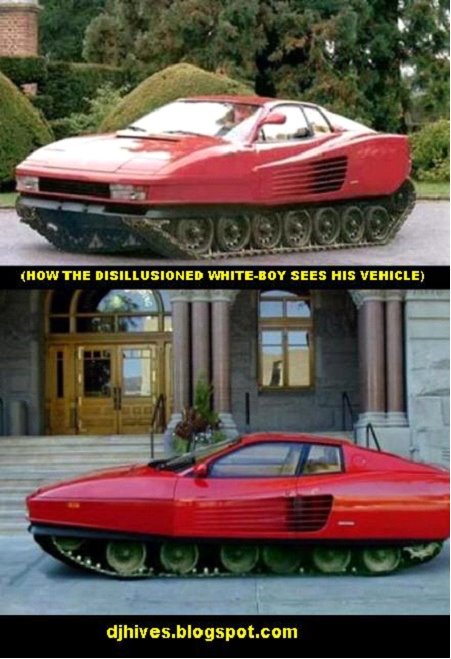

The two disillusioned attorneys were victims of an unfolding education hoax on the middle class that's just as insidious, and nearly as sweeping, as the housing debacle. The ingredients are strikingly similar, too: Misguided easy-money policies that are encouraging the masses to go into debt; a self-serving establishment trading in half-truths that exaggerate the value of its product; plus a Wall Street money machine dabbling in outright fraud as it foists unaffordable debt on the most vulnerable marks.

College graduates will earn $1 million more than those with only a high school diploma, brags Mercy College radio ads running in the New York area. The $1 million shibboleth is a favorite of college barkers.

Like many good cons, this one contains a kernel of truth. Census figures show that college grads earn an average of $57,500 a year, which is 82% more than the $31,600 high school alumni make. Multiply the $25,900 difference by the 40 years the average person works and, sure enough, it comes to a tad over $1 million.

But anybody who has gotten a passing grade in statistics knows what's wrong with this line of argument. A correlation between B.A.s and incomes is not proof of cause and effect. It may reflect nothing more than the fact that the economy rewards smart people and smart people are likely to go to college. To cite the extreme and obvious example: Bill Gates is rich because he knows how to run a business, not because he matriculated at Harvard. Finishing his degree wouldn't have increased his income.

All the while students have been lulled into thinking of the extra $1 million that will be theirs, they have been forced to disgorge an ever larger fraction of it in pursuit of the degree. While the premium that college grads earn over high schoolers has remained relatively constant over the past five years, the cost of acquiring a degree has risen at twice the rate of inflation, dramatically undermining any value a sheepskin adds.

Offsetting that million-dollar income discrepancy is the $46,700 four-year cost of tuition, fees, books, room and board at a public school and $99,900 at a private one--even after financial aid, scholarships and grants. Add all this to the equation and college grads don't pull even with high school grads in lifetime income until age 33 on average, the College Board says. Even that doesn't include the $125,000 in pay students forgo over four years.

"I call it the million-dollar misunderstanding," says Mark Schneider, vice president of the American Institutes for Research, of the prevailing propaganda.

Not only are college numbers spun. Some are patently spurious, says Richard Sander, a law professor at UCLA. Law schools lure in minority students to improve diversity rankings without disclosing that less than half of African-Americans who enter these programs ever pass the bar. Schools goose employment statistics by temporarily hiring new grads and spotlighting kids who land top-paying jobs, while glossing over far-lower average incomes. The one certainty: The average law grad owes $100,000 in student debt.

"There are a lot of aspects of selling education that are tinged with consumer fraud," Sander says. "There is a definite conspiracy to lead students down a primrose path."

Warped as the numbers are, they don't begin to account for the hidden cost of higher education: financing it. Borrowing has doubled over the past decade, to roughly $85 billion in new student loans in the 2007--08 academic year, bringing total student debt owed to well over half a trillion dollars. The average borrower went $19,200 into debt for a diploma in 2004, a 58% increase after inflation since 1993, according to the Project on Student Debt.

The proportion of students who graduate with more than $40,000 in debt jumped sixfold during that period, to 7.7% of the 1 million grads in 2004, or 77,500 people. Most will struggle for more than a decade to work it off, assuming relatively low 6.8% interest rates, the Project on Student Debt says.

For many, the terms are far worse. A decade ago nearly all student lending was of the low-cost, federally guaranteed variety, most of it with 6% to 8% interest kicking in only after a student left school. As costs outpaced such financing over the past decade, the share of student loans from "private" lenders rose from 7% to 23% of the market, or $20 billion in the 2007--08 academic year.

The rise of private student lending closely paralleled the subprime mortgage boom, which went from 8% of home loan originations in 2003 to 20% in 2006, before the housing meltdown sent that mortgage sector over a cliff. Private student loans resemble subprime mortgages in other ways, too. As banks and brokers did with subprime home loans, colleges and the lenders in cahoots with them commonly market private student loans alongside lower-cost alternatives, blurring the differences.

The key one is cost. Many private lenders tack 10% origination fees onto 18% variable interest rates (there is no legal limit), which begin accruing the moment a loan is funded. That has made private loans more than twice as profitable as government-guaranteed ones and lured heavy involvement from Citigroup , Bank of America and Wells Fargo .

New York Attorney General Andrew Cuomo has called private lending "the Wild West of the student loan industry." Some problems he notes smack of subprime mortgage lending: lax disclosure requirements, variable interest rates that compound and make paying off the principal a Sisyphean task, and kickback agreements by which lenders pay loan originators--in this case, colleges--a cut of their revenues.

State and federal authorities have taken action to curb the outright bribery. No less illustrious institutions of higher learning than Columbia University, New York University and the University of Pennsylvania paid $1 million-plus each to settle charges of wrongdoing in the student loan market.

Yet investigations still found "troubling, deceptive and often illegal practices . . . involving lenders, educational institutions and financial aid officials," according to Cuomo's office and the Congressional Committee on Education & Labor. Don't count on Washington to provide any more safeguards than it did with housing. Department of Education oversight of the student loan industry has been deemed insufficient by the Government Accountability Office.

Lacking honest input, three-quarters of high schoolers still seek to go on to college, many deluded about the financial prospects it holds, says American Institutes for Research's Schneider. "Part of the drive is the idea it pays," he says. "We need somebody making more realistic statements about the risks."

The risks are hefty. Half of students entering college never earn a degree. Six in ten African-Americans depart without one. "Hundreds of thousands of young people leave our higher education system unsuccessfully, burdened with large student loans that must be repaid, but without the benefit of the wages a college degree provides," warned a 2004 Education Trust study.

Among the half of entering students fortunate enough to get through college, millions go into debt for two-year associate degrees. These alumni outearn high school grads by only $8,400 a year. (Community colleges currently enroll 11.5 million.)

Tracy Kratzer, 27, enrolled in the International Academy of Design & Technology in Orlando, Fla. in 2003. With visions of making big bucks as a Web designer, she didn't give much thought to the interest rate on her loan from Sallie Mae , the Fannie Mae of student lending. Kratzer didn't know it at the time, but she was part of an experiment that has proved disastrous for borrowers and shareholders of Sallie's parent, SLM Corp. It's called "nontraditional" lending.

"That's not a sociological term," Albert Lord, chief executive of SLM Corp., told an audience of financial analysts last fall. "It's basically kids and parents with poor credit who are at the wrong schools."

Sallie Mae was set up by the government in 1972 and began privatizing its ownership in 1997. It began nontraditional lending in the easy-money heyday of 2002, when it cut deals with dozens of trade schools to become their preferred subprime student lender. Over the next four years Sallie doled out about $5 billion to people like Kratzer, waiving the credit scores and cosigners formerly required for its loans.

The bill arrived last year after nontraditional borrowers began entering the workforce. Of the half no longer studying, Sallie had written off 15% of loans by last June, the most recent period for which it has released figures; another 24% were delinquent. Among traditional loans for four-year universities, writeoffs ran 2% and delinquencies 4.9%.

SLM set aside $884 million to cover these bad loans in 2007 and posted its first loss. It expects nontraditional-loan writeoffs to peak this year. SLM's stock has lost 80% since the beginning of 2007, wiping out $15 billion in value. Lord, who was unavailable for comment, is a 28-year company veteran. He made $72 million as chief executive in 2007 by unloading SLM stock before it tanked. Sallie largely abandoned nontraditional lending last January.

That's little consolation to Kratzer. Shortly after graduating with an associate of arts degree, she discovered that the high-paying jobs she'd hoped to qualify for go to people with bachelor's degrees and years of experience. After a bout of unemployment, when she lived off credit cards, Kratzer recently found an hourly job as a clerk at a magazine, where she earns less than the average high school grad. In the meantime her $14,000 student loan has mushroomed to $27,000--more than she makes in a year--and continues to accrue interest at 18% a year. She says collection agents for Sallie and others hound her to hit up relatives for the money she owes.

"My mom works in a restaurant. My stepdad is in prison," says Kratzer. "There are so many people like me out there. They don't get seen. They don't get heard."

Mindy Babbitt entered Davenport University in her mid-20s to study accounting. Unable to cover the costs with her previous earnings as a cosmetologist, she took out a $35,000 student loan at 9% interest, figuring her postgraduate income would cover the cost.

Instead, the entry-level job her bachelor's degree got her barely covered living expenses. Babbitt deferred loan repayments and was then laid off for a time. Now 41 and living in Plainwell, Mich., she is earning $41,000 a year, or about $10,000 more than the average high school graduate makes. But since she graduated, Babbitt's student loan balance has more than doubled, to $87,000, and she despairs she'll never pay it off.

"Unless I win the lottery or get a job paying a lot more, my student debts are going to follow me to the grave," she says.

Babbitt is no oddity. In fact, one in four college grads takes home considerably less than the top quartile of high school grads, according to a College Board study. Even some people with doctorates earn less than people without so much as an associate degree, it shows.

For an indication of how out of touch the degree factories are with economic reality there's no need to pick on UCLA's course in queer musicology or Edith Cowan University's degree in "surf science." U.S. universities also minted 37,000 history degrees in 2006, including 852 Ph.D.s. That for a field with fewer than 500 job openings and average pay of $48,500. Plumbers, by contrast, enjoyed 16,000 new jobs that year and earned only $6,000 less than historians, census figures show.

Of course, not all history majors want to become historians. For many a bachelor's degree is nothing but a stepping-stone to a professional degree. Joel Kellum is one of those. After graduating from the University of Virginia, he got into California Western. Kellum approached a law professor about the wisdom of borrowing for the tuition.

"He said, 'Don't worry,'" Kellum recalls. "'We had the same thing when we were in school.'"

Kellum filled out a fat packet of forms in his school's financial aid office. Weeks later, he says, he got a call asking him to sign over a check to the school without any discussion of the loan terms. Kellum complied.

Only after he graduated, and his payments came due, did he dig into the details. What Kellum discovered was that, instead of cheap government loans, the bulk of his debt was in Signature loans: variable-rate debt from Sallie Mae. Kellum's variable rate has ticked as high as 9% and his ex-wife's to as much as 12%.

Like many grads, Kellum and Coultas hit bumps along their career paths. They deferred payments once when they were unemployed and twice more after their children were born. Each time, Kellum says, Sallie Mae tacked on fees for the delay. When he was a few days late making payments, he says, he got hit with more fees, which also accrued interest, and with a scolding.

"When you're a second late, you get 20 or 30 calls," he says. "It [Sallie Mae's Signature loan] is coated as a sweet government loan, but you can get better interest rates, and better treatment, borrowing from Vito in downtown Brooklyn."

Like Vito, private student lenders don't dwell on the dollar cost of compound interest. Cathelyn Gregoire says she applied for financial aid at the Tampa campus of the design school Kratzer attended and was assured she'd receive a loan at a fixed 7% rate. Three months after classes began Gregoire received a $14,000 loan. Only after graduating did she discover she was being charged a variable 13.25%, plus a "supplemental fee" of 6%. Her loan balance had jumped to $20,000 by the end of 2007.

Gregoire is now a plaintiff in a federal suit in Connecticut, accusing Sallie Mae of targeting minorities with deceptive lending. Her lawyers are trying to make it a class action.

Sallie Mae denies wrongdoing and distributes rate disclosures when students apply for loans, according to spokesperson Thomas Joyce. Sallie's disclosure document warns in capital letters that the rate a borrower sees may not be the one he gets.

Joyce says Sallie's borrowers receive detailed paperwork within ten days of funding and can rescind their loans then. In reality loan checks often go directly to schools after classes have begun. To rescind a loan a student must get the college to return the money. The student must then find new funding or drop out.

Education lenders, unlike other consumer financiers, are not required to provide Truth in Lending disclosures before reeling in borrowers. A law passed last year requires advanced disclosure, but not until 2010.

Get caught in this quagmire and you're stuck for good. Consumers who go on a credit card binge stand a good chance of getting debt discharged in bankruptcy. Not so if they take out a loan to educate themselves. Those loans, per the 2005 bankruptcy law, are not dischargeable. One reason: Without this exception, every student would run through a bankruptcy between graduation and starting a career.

Who gets stuck with these toxic loans? As with subprime mortgages, the people who can least afford them. A disproportionate number of high-interest student loans go to low-income students attending for-profit institutions, according to a 2008 study by Charlene Wear Simmons, assistant director of the California Research Bureau, an arm of the state government.

"Borrowing, combined with other risk factors for not completing higher education (such as working too many hours, lack of adequate preparation and part-time attendance), puts many students, especially low-income and first-generation students, at a particular disadvantage," says a 2005 study by Lawrence Gladieux, an education policy consultant, and Laura Perna, assistant professor of education at the University of Pennsylvania.

It's too late to save the country from the housing finance bubble. But the college bubble is not quite as far along.

Here's something they wont teach morans in college: SIMPLE MATH. You simply CANNOT BORROW TO GET AHEAD - it is mathematically impossible - it cannot be done --- ever! Sounds so EASY though! Just get free money to get da stuff that you want -- ya! you win!!! ..... FAIL!!!

As this article correctly pointed out - you may MAKE more when you graduate from slave school, but you will OWE MORE TOO!!!

A mook working at the Mac-Donnel makes $15 an hour ($30k) But has NO debt.

A DAN graduating college works in the global bio magnetic slave hive, class Luna and makes $30 an hour ($60k) BUT he has $150K in compounding DEBT!!!

DO THE MATH MORANOS!!!! LOL, you failures! The 'minimum wage' is nothing more than a calibration device to make sure that wages inflate at the same rate all across the board. Your typical $8 minimum wage today was yesterdays bachelors degree wage. Today it is $15 and $30 respectively. Monterous, moranic MORANS!!!

OOOOHHHHHHH LOOK AT THE COLLEGE BOY!!

WOOT!!!

The Great College Hoax

Law Students in Heavy Debt

Kathy Kristof 02.02.09

Forbes

As steadily as ivy creeps up the walls of its well-groomed campuses, the education industrial complex has cultivated the image of college as a sure-fire path to a life of social and economic privilege.

Joel Kellum says he's living proof that the claim is a lie. A 40-year-old Los Angeles resident, Kellum did everything he was supposed to do to get ahead in life. He worked hard as a high schooler, got into the University of Virginia and graduated with a bachelor's degree in history.

Accepted into the California Western School of Law, a private San Diego institution, Kellum couldn't swing the $36,000 in annual tuition with financial aid and part-time work. So he did what friends and professors said was the smart move and took out $60,000 in student loans.

Kellum's law school sweetheart, Jennifer Coultas, did much the same. By the time they graduated in 1995, the couple was $194,000 in debt. They eventually married and each landed a six-figure job. Yet even with Kellum moonlighting, they had to scrounge to come up with $145,000 in loan payments. With interest accruing at up to 12% a year, that whittled away only $21,000 in principal. Their remaining bill: $173,000 and counting.

Kellum and Coultas divorced last year. Each cites their struggle with law school debt as a major source of stress on their marriage. "Two people with this much debt just shouldn't be together," Kellum says.

The two disillusioned attorneys were victims of an unfolding education hoax on the middle class that's just as insidious, and nearly as sweeping, as the housing debacle. The ingredients are strikingly similar, too: Misguided easy-money policies that are encouraging the masses to go into debt; a self-serving establishment trading in half-truths that exaggerate the value of its product; plus a Wall Street money machine dabbling in outright fraud as it foists unaffordable debt on the most vulnerable marks.

College graduates will earn $1 million more than those with only a high school diploma, brags Mercy College radio ads running in the New York area. The $1 million shibboleth is a favorite of college barkers.

Like many good cons, this one contains a kernel of truth. Census figures show that college grads earn an average of $57,500 a year, which is 82% more than the $31,600 high school alumni make. Multiply the $25,900 difference by the 40 years the average person works and, sure enough, it comes to a tad over $1 million.

But anybody who has gotten a passing grade in statistics knows what's wrong with this line of argument. A correlation between B.A.s and incomes is not proof of cause and effect. It may reflect nothing more than the fact that the economy rewards smart people and smart people are likely to go to college. To cite the extreme and obvious example: Bill Gates is rich because he knows how to run a business, not because he matriculated at Harvard. Finishing his degree wouldn't have increased his income.

All the while students have been lulled into thinking of the extra $1 million that will be theirs, they have been forced to disgorge an ever larger fraction of it in pursuit of the degree. While the premium that college grads earn over high schoolers has remained relatively constant over the past five years, the cost of acquiring a degree has risen at twice the rate of inflation, dramatically undermining any value a sheepskin adds.

Offsetting that million-dollar income discrepancy is the $46,700 four-year cost of tuition, fees, books, room and board at a public school and $99,900 at a private one--even after financial aid, scholarships and grants. Add all this to the equation and college grads don't pull even with high school grads in lifetime income until age 33 on average, the College Board says. Even that doesn't include the $125,000 in pay students forgo over four years.

"I call it the million-dollar misunderstanding," says Mark Schneider, vice president of the American Institutes for Research, of the prevailing propaganda.

Not only are college numbers spun. Some are patently spurious, says Richard Sander, a law professor at UCLA. Law schools lure in minority students to improve diversity rankings without disclosing that less than half of African-Americans who enter these programs ever pass the bar. Schools goose employment statistics by temporarily hiring new grads and spotlighting kids who land top-paying jobs, while glossing over far-lower average incomes. The one certainty: The average law grad owes $100,000 in student debt.

"There are a lot of aspects of selling education that are tinged with consumer fraud," Sander says. "There is a definite conspiracy to lead students down a primrose path."

Warped as the numbers are, they don't begin to account for the hidden cost of higher education: financing it. Borrowing has doubled over the past decade, to roughly $85 billion in new student loans in the 2007--08 academic year, bringing total student debt owed to well over half a trillion dollars. The average borrower went $19,200 into debt for a diploma in 2004, a 58% increase after inflation since 1993, according to the Project on Student Debt.

The proportion of students who graduate with more than $40,000 in debt jumped sixfold during that period, to 7.7% of the 1 million grads in 2004, or 77,500 people. Most will struggle for more than a decade to work it off, assuming relatively low 6.8% interest rates, the Project on Student Debt says.

For many, the terms are far worse. A decade ago nearly all student lending was of the low-cost, federally guaranteed variety, most of it with 6% to 8% interest kicking in only after a student left school. As costs outpaced such financing over the past decade, the share of student loans from "private" lenders rose from 7% to 23% of the market, or $20 billion in the 2007--08 academic year.

The rise of private student lending closely paralleled the subprime mortgage boom, which went from 8% of home loan originations in 2003 to 20% in 2006, before the housing meltdown sent that mortgage sector over a cliff. Private student loans resemble subprime mortgages in other ways, too. As banks and brokers did with subprime home loans, colleges and the lenders in cahoots with them commonly market private student loans alongside lower-cost alternatives, blurring the differences.

The key one is cost. Many private lenders tack 10% origination fees onto 18% variable interest rates (there is no legal limit), which begin accruing the moment a loan is funded. That has made private loans more than twice as profitable as government-guaranteed ones and lured heavy involvement from Citigroup , Bank of America and Wells Fargo .

New York Attorney General Andrew Cuomo has called private lending "the Wild West of the student loan industry." Some problems he notes smack of subprime mortgage lending: lax disclosure requirements, variable interest rates that compound and make paying off the principal a Sisyphean task, and kickback agreements by which lenders pay loan originators--in this case, colleges--a cut of their revenues.

State and federal authorities have taken action to curb the outright bribery. No less illustrious institutions of higher learning than Columbia University, New York University and the University of Pennsylvania paid $1 million-plus each to settle charges of wrongdoing in the student loan market.

Yet investigations still found "troubling, deceptive and often illegal practices . . . involving lenders, educational institutions and financial aid officials," according to Cuomo's office and the Congressional Committee on Education & Labor. Don't count on Washington to provide any more safeguards than it did with housing. Department of Education oversight of the student loan industry has been deemed insufficient by the Government Accountability Office.

Lacking honest input, three-quarters of high schoolers still seek to go on to college, many deluded about the financial prospects it holds, says American Institutes for Research's Schneider. "Part of the drive is the idea it pays," he says. "We need somebody making more realistic statements about the risks."

The risks are hefty. Half of students entering college never earn a degree. Six in ten African-Americans depart without one. "Hundreds of thousands of young people leave our higher education system unsuccessfully, burdened with large student loans that must be repaid, but without the benefit of the wages a college degree provides," warned a 2004 Education Trust study.

Among the half of entering students fortunate enough to get through college, millions go into debt for two-year associate degrees. These alumni outearn high school grads by only $8,400 a year. (Community colleges currently enroll 11.5 million.)

Tracy Kratzer, 27, enrolled in the International Academy of Design & Technology in Orlando, Fla. in 2003. With visions of making big bucks as a Web designer, she didn't give much thought to the interest rate on her loan from Sallie Mae , the Fannie Mae of student lending. Kratzer didn't know it at the time, but she was part of an experiment that has proved disastrous for borrowers and shareholders of Sallie's parent, SLM Corp. It's called "nontraditional" lending.

"That's not a sociological term," Albert Lord, chief executive of SLM Corp., told an audience of financial analysts last fall. "It's basically kids and parents with poor credit who are at the wrong schools."

Sallie Mae was set up by the government in 1972 and began privatizing its ownership in 1997. It began nontraditional lending in the easy-money heyday of 2002, when it cut deals with dozens of trade schools to become their preferred subprime student lender. Over the next four years Sallie doled out about $5 billion to people like Kratzer, waiving the credit scores and cosigners formerly required for its loans.

The bill arrived last year after nontraditional borrowers began entering the workforce. Of the half no longer studying, Sallie had written off 15% of loans by last June, the most recent period for which it has released figures; another 24% were delinquent. Among traditional loans for four-year universities, writeoffs ran 2% and delinquencies 4.9%.

SLM set aside $884 million to cover these bad loans in 2007 and posted its first loss. It expects nontraditional-loan writeoffs to peak this year. SLM's stock has lost 80% since the beginning of 2007, wiping out $15 billion in value. Lord, who was unavailable for comment, is a 28-year company veteran. He made $72 million as chief executive in 2007 by unloading SLM stock before it tanked. Sallie largely abandoned nontraditional lending last January.

That's little consolation to Kratzer. Shortly after graduating with an associate of arts degree, she discovered that the high-paying jobs she'd hoped to qualify for go to people with bachelor's degrees and years of experience. After a bout of unemployment, when she lived off credit cards, Kratzer recently found an hourly job as a clerk at a magazine, where she earns less than the average high school grad. In the meantime her $14,000 student loan has mushroomed to $27,000--more than she makes in a year--and continues to accrue interest at 18% a year. She says collection agents for Sallie and others hound her to hit up relatives for the money she owes.

"My mom works in a restaurant. My stepdad is in prison," says Kratzer. "There are so many people like me out there. They don't get seen. They don't get heard."

Mindy Babbitt entered Davenport University in her mid-20s to study accounting. Unable to cover the costs with her previous earnings as a cosmetologist, she took out a $35,000 student loan at 9% interest, figuring her postgraduate income would cover the cost.

Instead, the entry-level job her bachelor's degree got her barely covered living expenses. Babbitt deferred loan repayments and was then laid off for a time. Now 41 and living in Plainwell, Mich., she is earning $41,000 a year, or about $10,000 more than the average high school graduate makes. But since she graduated, Babbitt's student loan balance has more than doubled, to $87,000, and she despairs she'll never pay it off.

"Unless I win the lottery or get a job paying a lot more, my student debts are going to follow me to the grave," she says.

Babbitt is no oddity. In fact, one in four college grads takes home considerably less than the top quartile of high school grads, according to a College Board study. Even some people with doctorates earn less than people without so much as an associate degree, it shows.

For an indication of how out of touch the degree factories are with economic reality there's no need to pick on UCLA's course in queer musicology or Edith Cowan University's degree in "surf science." U.S. universities also minted 37,000 history degrees in 2006, including 852 Ph.D.s. That for a field with fewer than 500 job openings and average pay of $48,500. Plumbers, by contrast, enjoyed 16,000 new jobs that year and earned only $6,000 less than historians, census figures show.

Of course, not all history majors want to become historians. For many a bachelor's degree is nothing but a stepping-stone to a professional degree. Joel Kellum is one of those. After graduating from the University of Virginia, he got into California Western. Kellum approached a law professor about the wisdom of borrowing for the tuition.

"He said, 'Don't worry,'" Kellum recalls. "'We had the same thing when we were in school.'"

Kellum filled out a fat packet of forms in his school's financial aid office. Weeks later, he says, he got a call asking him to sign over a check to the school without any discussion of the loan terms. Kellum complied.

Only after he graduated, and his payments came due, did he dig into the details. What Kellum discovered was that, instead of cheap government loans, the bulk of his debt was in Signature loans: variable-rate debt from Sallie Mae. Kellum's variable rate has ticked as high as 9% and his ex-wife's to as much as 12%.

Like many grads, Kellum and Coultas hit bumps along their career paths. They deferred payments once when they were unemployed and twice more after their children were born. Each time, Kellum says, Sallie Mae tacked on fees for the delay. When he was a few days late making payments, he says, he got hit with more fees, which also accrued interest, and with a scolding.

"When you're a second late, you get 20 or 30 calls," he says. "It [Sallie Mae's Signature loan] is coated as a sweet government loan, but you can get better interest rates, and better treatment, borrowing from Vito in downtown Brooklyn."

Like Vito, private student lenders don't dwell on the dollar cost of compound interest. Cathelyn Gregoire says she applied for financial aid at the Tampa campus of the design school Kratzer attended and was assured she'd receive a loan at a fixed 7% rate. Three months after classes began Gregoire received a $14,000 loan. Only after graduating did she discover she was being charged a variable 13.25%, plus a "supplemental fee" of 6%. Her loan balance had jumped to $20,000 by the end of 2007.

Gregoire is now a plaintiff in a federal suit in Connecticut, accusing Sallie Mae of targeting minorities with deceptive lending. Her lawyers are trying to make it a class action.

Sallie Mae denies wrongdoing and distributes rate disclosures when students apply for loans, according to spokesperson Thomas Joyce. Sallie's disclosure document warns in capital letters that the rate a borrower sees may not be the one he gets.

Joyce says Sallie's borrowers receive detailed paperwork within ten days of funding and can rescind their loans then. In reality loan checks often go directly to schools after classes have begun. To rescind a loan a student must get the college to return the money. The student must then find new funding or drop out.

Education lenders, unlike other consumer financiers, are not required to provide Truth in Lending disclosures before reeling in borrowers. A law passed last year requires advanced disclosure, but not until 2010.

Get caught in this quagmire and you're stuck for good. Consumers who go on a credit card binge stand a good chance of getting debt discharged in bankruptcy. Not so if they take out a loan to educate themselves. Those loans, per the 2005 bankruptcy law, are not dischargeable. One reason: Without this exception, every student would run through a bankruptcy between graduation and starting a career.

Who gets stuck with these toxic loans? As with subprime mortgages, the people who can least afford them. A disproportionate number of high-interest student loans go to low-income students attending for-profit institutions, according to a 2008 study by Charlene Wear Simmons, assistant director of the California Research Bureau, an arm of the state government.

"Borrowing, combined with other risk factors for not completing higher education (such as working too many hours, lack of adequate preparation and part-time attendance), puts many students, especially low-income and first-generation students, at a particular disadvantage," says a 2005 study by Lawrence Gladieux, an education policy consultant, and Laura Perna, assistant professor of education at the University of Pennsylvania.

It's too late to save the country from the housing finance bubble. But the college bubble is not quite as far along.

Here's something they wont teach morans in college: SIMPLE MATH. You simply CANNOT BORROW TO GET AHEAD - it is mathematically impossible - it cannot be done --- ever! Sounds so EASY though! Just get free money to get da stuff that you want -- ya! you win!!! ..... FAIL!!!

As this article correctly pointed out - you may MAKE more when you graduate from slave school, but you will OWE MORE TOO!!!

A mook working at the Mac-Donnel makes $15 an hour ($30k) But has NO debt.

A DAN graduating college works in the global bio magnetic slave hive, class Luna and makes $30 an hour ($60k) BUT he has $150K in compounding DEBT!!!

DO THE MATH MORANOS!!!! LOL, you failures! The 'minimum wage' is nothing more than a calibration device to make sure that wages inflate at the same rate all across the board. Your typical $8 minimum wage today was yesterdays bachelors degree wage. Today it is $15 and $30 respectively. Monterous, moranic MORANS!!!

OOOOHHHHHHH LOOK AT THE COLLEGE BOY!!

WOOT!!!

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment